In 1998, three professors from Trinity University in San Antonio, Texas published a research paper known as the Trinity Study. This study is regarded as a major work on the topic of safe withdrawal rates for retirees. The authors used historical data to determine the amount of money that retirees can withdraw from their investment portfolios each year without running out of money. The study found that a withdrawal rate of 4% is safe for a balanced portfolio of stocks and bonds over a 30-year retirement period. The results of the study had a significant impact on the development of retirement planning strategies.

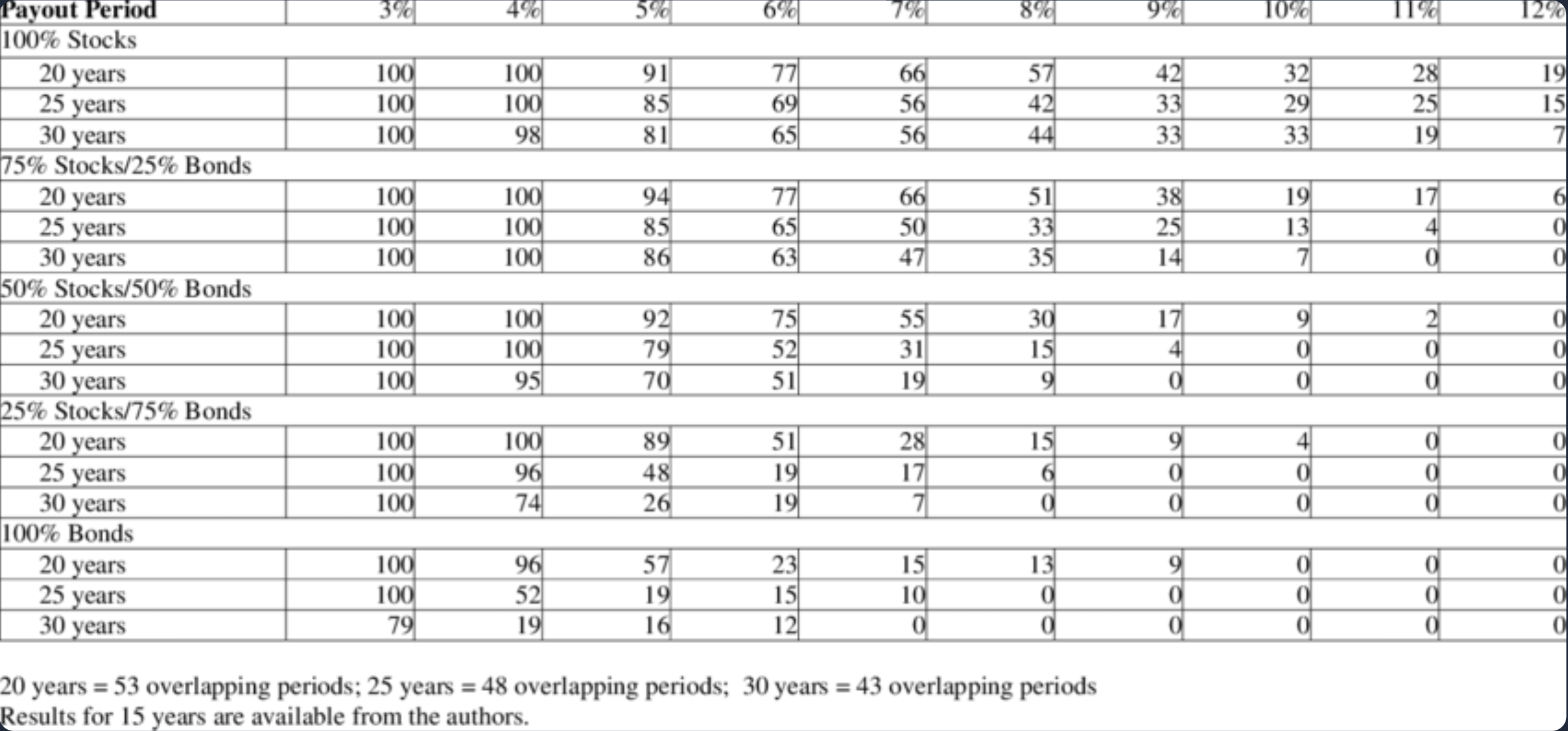

In the matrix below, having a portfolio split of 75% stocks/25% bonds, would give you a 77% success rate with a withdrawal of 6% of your initial portfolio.

Portfolio Success Rate with Inflation Adjusted Monthly Withdrawals: 1926 to 1997 (Percent of all past payout periods supported by the portfolio) Annualized Withdrawal Rate as a % of Initial Portfolio Value

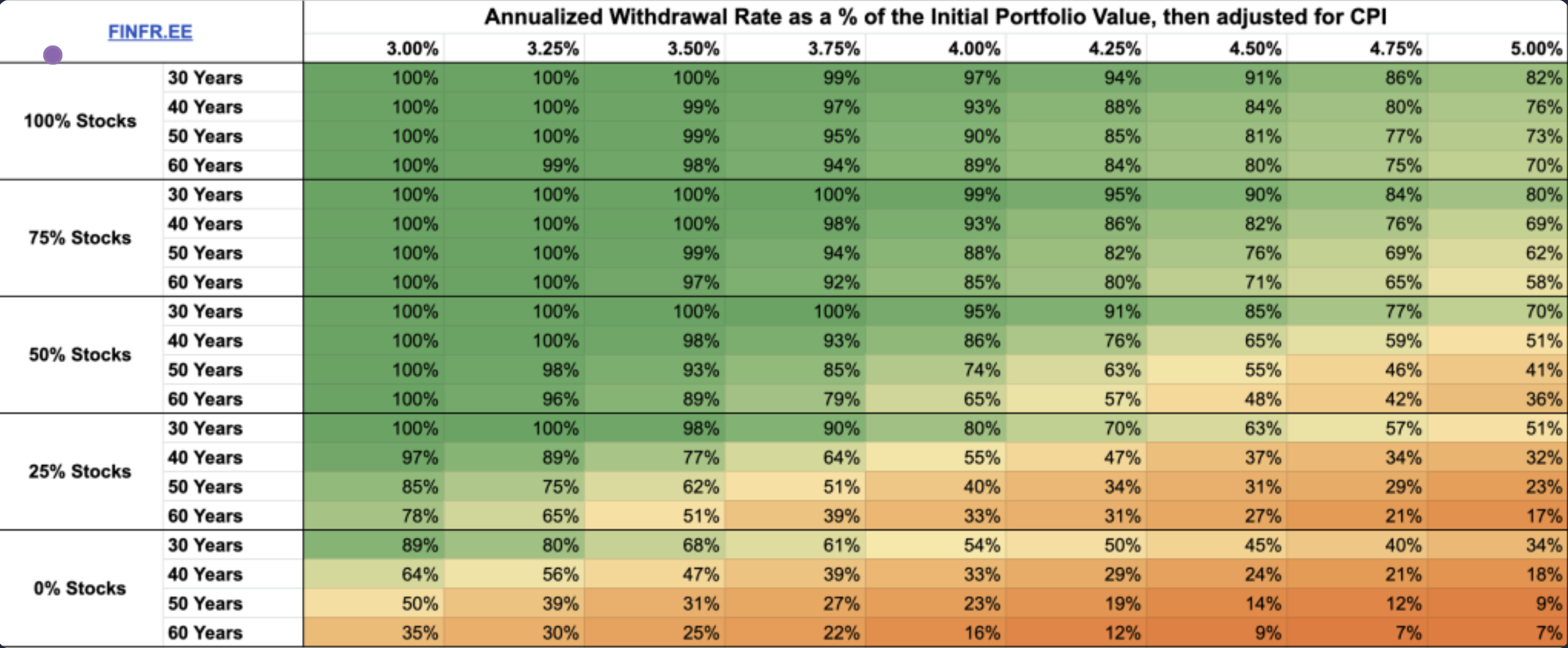

Adjusted Matrix for 2025 #

A few points to take into account:

- A 4% withdrawal rate is safe for a balanced portfolio of stocks and bonds over a 30-year retirement period. It’s consistent with success rates for a 30-year horizon. However, for longer horizons, success probabilities deteriorate and a higher equity share is needed to maintain high success rates.

- For example, while a 50-100% equity share and withdrawal rate of 4% or lower may provide consistently high success rates for a 30-year horizon, a 100% equity share is necessary to maintain high success rates over a 60-year horizon.

- Withdrawal rates higher than 4% are not recommended

- ==Highest success probability is using 75-100% equity shares with a withdrawal strategy of 3.5% and under==

Additional reading.

Cooley, Philip L., Hubbard, Carl M., and Walz, Daniel T. “Sustainable withdrawal rates from your retirement portfolio”

Cooley, Philip L., Hubbard, Carl M., and Walz, Daniel T. “Portfolio success rates: where to draw the line.”