Why a budget? #

Having a budget system is essential for gaining control of your finances and making sure that your expenses stay below your income. By having a clear understanding of your income and expenses, you can ensure that your money is managed effectively and that you remain financially stable.

“Do not save what is left after spending; instead spend what is left after saving.” – Warren Buffett

After trying a variety of budgeting tools such as Quicken, Banktivity, and Excel sheets, I recently discovered YNAB. At first, I was skeptical of yet another budgeting tool, but I’m glad to say that YNAB has exceeded my expectations.

As a non-US resident or citizen, I found it difficult to find a budgeting tool that I could use which fulfills all my needs. YNAB solved this problem for me, and I’m really pleased with the results.

It has a user-friendly interface that makes it easy to understand and navigate. You can easily categorize and track your expenses, and set up budgets with detailed insight. There are also a number of helpful resources, tips, and tutorials available to help you get started.

Overall, I’m very impressed with YNAB and would highly recommend it for budgeting. It’s a great tool for anyone.

What are the benefits of Budgeting #

Budgeting not only helps you manage your finances and understand your cash flow, but it also has several additional benefits. Some of these benefits include:

- Increased savings and investment opportunities

- The ability to prioritize spending on what truly matters to you

- Reduced stress and anxiety related to money

- Improved overall financial well-being

- Better control over impulse spending

- More clarity on where your money is going

- Helps in reaching financial goals faster.

You Need a Budget! #

You Need a Budget (YNAB) is so far my favorite budgeting tool. At first, I found it challenging to figure out how to use the credit card expenses feature. However, after watching the tutorials and videos, I was able to quickly set it up and get the hang of it in just a few minutes.

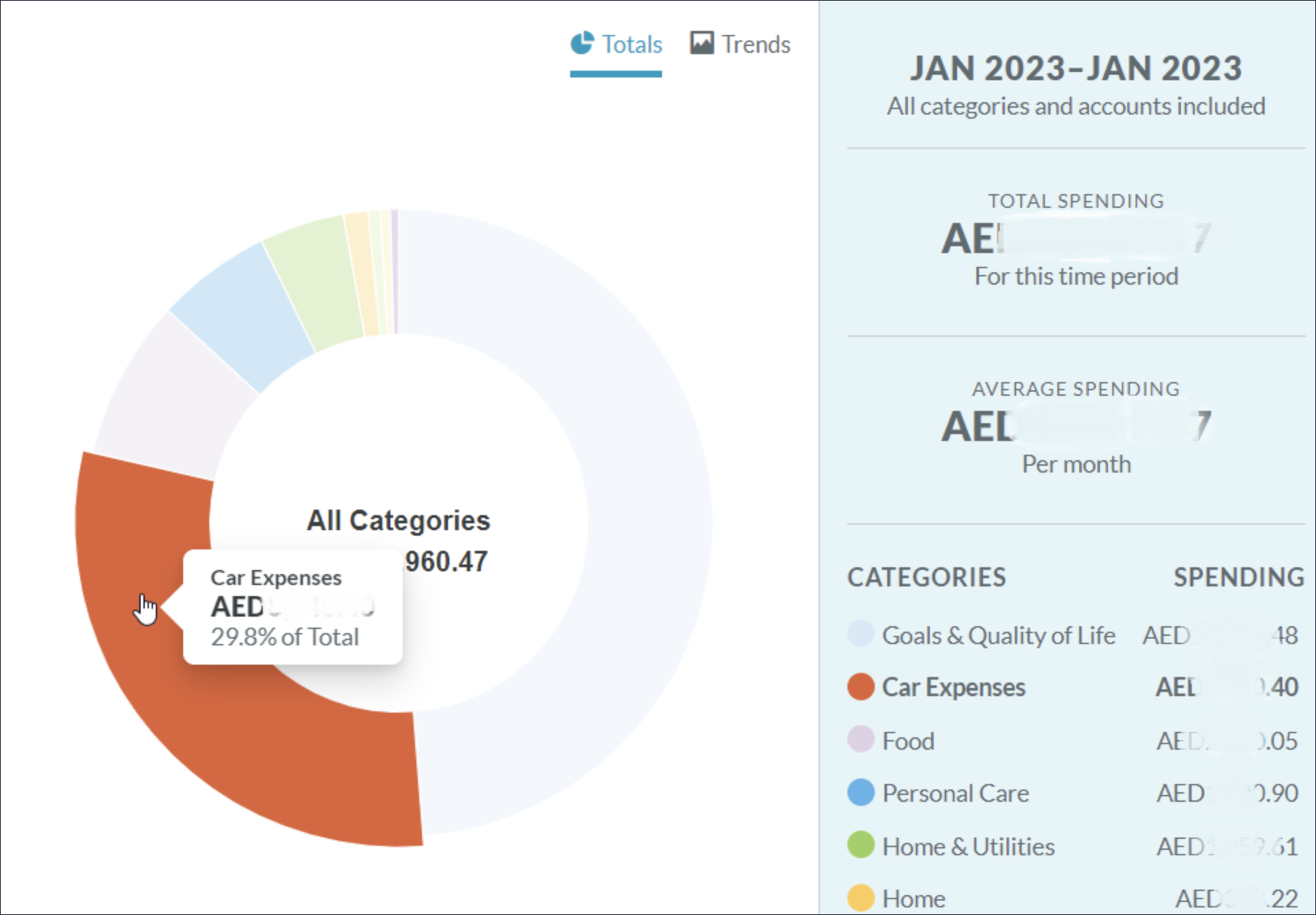

It offers an impressive array of features, including secure syncing with all your bank accounts, real-time updates so you can track and manage your finances even when you’re on the go, debt paydown and goal-tracking tools, and helpful analytics and reports on your income and expenses.

YNAB follows 4 simple rules: #

YNAB follows 4 simple rules:

==1. Give Every Dollar a Job==: Every dollar you earn should have a purpose. When you assign a job to each dollar you can make sure you’re spending, saving, and investing your money in a way that aligns with your financial goals.

==2. Embrace Your True Expenses==: Financial success isn’t just about cutting back on buying a latte every day. To truly succeed you need to plan for the big expenses that come up throughout the year, like car maintenance, vacations, and holidays.

==3. Roll With the Punches==: Life happens and sometimes you have to adjust your budget. YNAB encourages you to adjust your budget when expenses change and to be flexible when life throws you a curveball.

==4. Age Your Money==: YNAB encourages you to save up for larger expenses and build an emergency fund so you’re not living paycheck to paycheck. This will help you reduce debt and increase your financial security. This is one of the great features of YNAB.

What else does it offer? #

YNAB also offers features and services that can help you stay on track with your budget and reach your financial goals.

These include:

– Automated budgeting: YNAB automatically updates your budget based on your transactions, so you don’t have to manually enter them. This feature is primarily for US customers. Personally, I like to have full manual control over it. On top of that, the less you spend the less transactions.

– Goal tracking: Set specific goals and track your progress towards them. A great feature.

– Multi Currency Accounts: This might not be necessary for most people, but as an expat, this is a must have.

– Debt repayment plans: Create a plan to pay off debt and get out of the red.

– Investment tracking: Monitor your investment accounts and get a better understanding of your financial health.

– Reports and insights: Get a detailed view of your spending and saving habits with YNAB’s reports and insights. This one could be better. Reporting is very basic.

– Live support: Get help with budgeting questions or technical issues from YNAB’s live customer support team.

Conclusion #

Creating a budget may seem daunting, but the effort is worthwhile. With patience and persistence, you’ll gain confidence in managing your finances and gain insight into your cash flow. This balance between income and expenses will enable you to save, invest, and spend on what truly matters to you.

When starting to use YNAB or any other budgeting tool, it’s important to be forgiving with yourself. Input numbers as accurately as possible. It’s likely that you will need to make adjustments for the first few months as you discover the difference between what you think you spend and what you actually spend.

If you’re interested in trying out YNAB, you can get a free month by clicking on my referral link. As a bonus, I will also get a free month!

==Signup YNAB==